February 12, 2024

The False Claims Act requires a penalty for each each violation. The FCA penalty amount also increases with inflation each year. Currently, False Claims Act penalties range as high as $27,894 per violation. With some frauds involving tens of thousands of individual violations, however, total False Claims Act penalty assessments can run into the millions or tens of millions of dollars.

Unfortunately, whistleblowers and lawyers often fail to understand how significant FCA penalties can be to a total False Claims Act award. This leads them to they ignore statutory penalties when valuing a case. However, understanding the nuances of False Claims Act penalties is key to properly understanding their impact on a case.

Contents:

The False Claims Act, 31 U.S.C. §§ 3729, provides that anyone who violates the law is liable for a civil penalty in addition to three times the damages. In addition, False Claims Act penalties are sometimes referred to as statutory penalties, civil penalties, or fines. The original version of the False Claims Act also referred to penalties as “forfeitures” and some sources still use that term.

The False Claims Act is intended to reach all fraudulent attempts to cause the Government to pay out sums of money or to deliver property or services. United States v. Neifert-White Co., 390 U.S. 228, 232 (1968). Thus, the key to calculating FCA penalties is to count the number of violations of the statute.

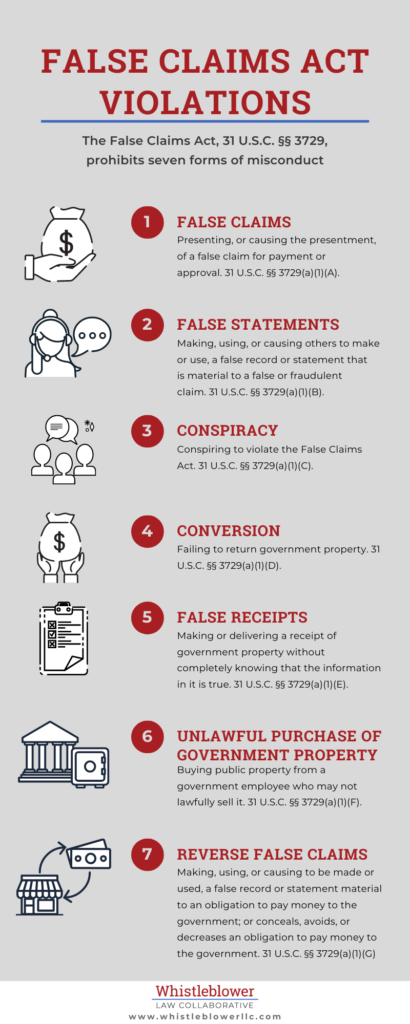

The current version of the False Claims Act lists seven types of violation:

Within these seven categories of violation, there are many ways to run afoul of the False Claims Act. If you are still curious, check out False Claims Act Violations and Prohibitions Explained.

Congress made clear that the law imposes a penalty (then called a forfeiture) for every violation of the False Claims Act. This means, in a prosecution for making false claims under 31 U.S.C. §§ 3729(a)(1)(A),

Each separate bill, voucher or other “false payment demand” constitutes a separate claim for which a forfeiture shall be imposed and this is true although many such claims may be submitted to the Government at one time.

S. Rep. No. 99-345, at 9-10, reprinted in 1986 U.S.C.C.A.N. at 5274. Often a single fraudulent scheme will generate many, even thousands of false claims, and each of these warrants a penalty. For example, in health care fraud, statutory penalties usually flow from each false form. Thus,

a doctor who completes separate Medicare claims for each patient treated will be liable for a forfeiture for each such form that contains false entries even though several such forms may be submitted to the fiscal intermediary at one time.

Id. And when a physician is ineligible to participate in Medicare, “all Medicare claims submitted by or on behalf of a physician who is ineligible to participate in the program” generate a penalty. Id.

The same is true when a contractor obtains a contract by fraud:

each and every claim submitted under a contract, loan guarantee, or other agreement which was originally obtained by means of false statements or other corrupt or fraudulent conduct, or in violation of any statute or applicable regulation, constitutes a false claim. For example, all claims submitted under a contract obtained through collusive bidding are false and actionable under the act.

S. Rep. No. 99-345, at 9-10, reprinted in 1986 U.S.C.C.A.N. at 5274.

In United States v. Bornstein, the government sued Model Engineering, an electron tube producer under the False Claims Act. 423 U.S. 303, 313 (1976). Model sold faulty electron tubes to United, which were then used to make radio kits and subsequently sold to the military. The government sued Model because it “caused” the presentment of false claims under an earlier version of the False Claims Act. Bornstein at 313.

The Supreme Court agreed that the False Claims Act “permits recovery of multiple forfeitures” (penalties). Bornstein at 309. However, the defendant argued that it could only be liable for one civil penalty for each contract. But the Supreme Court said that is wrong:

To equate the number of forfeitures with the number of contracts would in a case such as this result almost always in but a single forfeiture, no matter how many fraudulent acts the subcontractor might have committed. This result would not only be at odds with the statutory language; it would also defeat the statutory purpose. Such a limitation would, in the language of the Government’s brief, convert the Act’s forfeiture provision into little more than a $2,000 license for subcontractor fraud.

Bornstein at 311. Instead, the Court decided that when a subcontractor “causes” a prime contractor to make false claims, the FCA penalties are the number of acts of causation.

If United had committed one act which caused Model to file a false claim, it would clearly be liable for a single forfeiture. . . . If, on the other hand, United had committed three separate such causative acts, United would be liable for three forfeitures, even if Model had filed only one false claim.

Bornstein at 312. Importantly, however, the government sued Model only for causing false claims. Justice Rehnquist wrote a separate concurrence explaining that the false claims act also requires FCA penalties for making false statements in violation of 31 U.S.C. §§ 3729(a)(1)(B). Those civil penalties “turn on the number of false bills, certificates, affidavits, etc., made or used, or caused to be made or used.” Bornstein at 323 n.6.

The principle that a statutory penalty, fine, or forfeiture is required for each violation of the False Claims Act, not just each false claim, has been upheld in numerous federal cases. Some examples:

Once you have figured out how many statutory penalties should be imposed, the second step is to figure out the fine range per violation. The False Claims Act sets penalties at $5,000 to $10,000 per violation. However, subsequent federal law periodically adjusts the amounts for inflation. As of February 12, 2024, FCA penalties range from $13,946 to $27,894 per violation.

The 1986 False Claims Act set the penalty to $5000 to $10,000 for each violation. Subsequent federal law, however, changed these amounts to adjust for inflation.

In 1990 Congress passed the Federal Civil Monetary Penalties Inflation Adjustment Act of 1990, Pub.L. 101-410. That law stated that every five years, federal agencies would update FCA penalties for violations occurring after that date. In 1996, Congress then amended that law to limit the initial increase to 10 percent of the maximum penalty. 110 Stat. 1321–373 (Apr. 26, 1996).

In 1999, DOJ adjusted the False Claims Act penalties range for the first time. This amendment applied to violations occurring after September 29, 1999. In other words, this increased applies only to underlying conduct that occurs after 1999. For those violations, it raised the FCA civil penalty range to $5,500 to $11,000. 64 Fed. Reg. 47099, 47103 at § 85.3.

The Bipartisan Budget Act of 2015, Public Law 114-74 (Nov. 2, 2015), again revised the method for adjusting FCA penalties for inflation. As a result, the government adjusts the civil penalties ranges every year. In addition, the 10% cap was replaced by a %150 cap, meaning that False Claims Act penalties could increase by as much as 2.5 times over the prior FCA penalty range.

New adjustments now apply to all post-November 2015 violations. In other words, for conduct occurring after November 2015, FCA civil penalties are determined by the last (most recent) adjustment when the court imposes penalties.

False Claims Act penalties inflation adjustments are published in the Federal Register. Thereafter, they are codified in a chart in the Code of Federal Regulations at 28 C.F.R. § 85.5.

DOJ did not adjust the FCA penalties for almost a year after the Bipartisan Budget Act. Statutory penalties imposed during that period, for conduct occurring after November 3, 2015 continued to range from $5,500 to $11,000.

In June 2016, DOJ published a rule adjusting the False Claims Act civil penalties range for the first time since 1999. 81 Fed. Reg. 42491. The rule took affect on August 1, 2016. Because it had been so long since False Claims Act penalties had been adjusted, the increase was substantial. FCA penalties assessed after August 1, 2016 for post November 3, 2015 conduct, more than doubled to $10,781 to $21,563.

In February 2017, DOJ adjusted the False Claims Act penalties range for 2017. 82 Fed. Reg. 9131. Accordingly, FCA penalties assessed after February 3, 2017 for post November 3, 2015 conduct, are $10,957 to $21,916.

In January, 2018, DOJ adjusted the FCA statutory penalties range for 2018. 83 Fed. Reg. 3944. Therefore, False Claims Act penalties during that period ranged from $11,181 to $22,363. Despite the requirements in the law, DOJ did not adjust the 2019 False Claims Act Penalties. However, two other agencies did.

On June 19, 2020, DOJ adjusted the FCA statutory penalties range for 2020. 85 Fed. Reg. 37004 This adjustment included a catch up for 1999. Thus, 2020 False Claims Act penalties assessed after June 19, 2020 for post November 3, 2015 conduct, are $11,665 to $23,331.

On December 13, 2021 DOJ adjusted the FCA 2021 False Claims Act penalties. 86 Fed. 70740. As a result, between December 13, 2021 and May 8, 2022, False Claims Act Penalties, for conduct after November 2, 2015, will be from $11,803 to $23,607.

On May 9, 2022, DOJ adjusted the FCA 2022 False Claims Act penalties. 87 FR 27513. The adjustment was less than 6 months after its prior increase in December 2021 and aligned with the penalty amounts in Railroad Retirement Board and Commerce Department cases.

On January 30, 2023, DOJ adjusted the FCA 2023 False Claims Act penalties, 88 FR 5776. This adjustment was approximately 8 months after the prior adjustment in May 2022.

On February 12, 2024, DOJ adjusted the FCA 2024 False Claims Act penalties, 89 FR 9764. This adjustment was just less than one year after the prior increase in 2023.

Once you know the number of available False Claims Act statutory penalties and the applicable range, you can calculate a broad range of potential FCA penalties. But, the third step of the analysis is setting the exact number of False Claims Act penalties and penalty per violation. As we explain, in court, there is a role for both a jury and a judge. The jury determines the number of FCA penalties and the judge decided the False Claims Act penalty per violation. In a settlement, however, the government generally does not seek any penalties.

The jury decides the number of violations. United States v. Capitol Supply, Inc., Civil Action No. 10-1094, 2 (D.D.C. Sep. 20, 2017). This is because, as in all litigation, it is the jury’s job to decide questions of fact. On the other hand, it is the judge’s job to decide issues of law. For False Claims Act penalties, this means that the jury decides the number of violations, and later, a judge decides on the FCA penalty for each violation.

Once a violation is established, a False Claims Act penalty is mandatory for each violation. Congress explained clearly that imposition of a False Claims Act forfeiture is automatic and mandatory for each claim which is found to be false. S. Rep. No. 99-345, at 8, reprinted in 1986 U.S.C.C.A.N. at 5274. Courts have subsequently agreed that imposition of an FCA penalty is mandatory for each false claim. In re Schimmels, 85 F.3d 416, 419 n.1 (9th Cir. 1996) (In addition to treble damages, the FCA also requires a court to award not less than $5,000 and not more than $10,000 for each false claim or statement submitted to the government, even if no damages were caused by the false submissions.).

Once the jury sets the number of violations, it plays no role in setting the amount of False Claims Act penalties. United States ex rel. Landis v. Tailwind Sports Corp., 292 F. Supp. 3d 211, 214–15 (D.D.C. 2017). In Cook County v. United States ex rel. Chandler, the Supreme Court explained that in a False Claims Act case, the “court alone” sets the FCA penalty. 538 U.S. 119, 132 (2003).

Courts are given, “considerable discretion” in setting False Claims Act penalty amounts. U.S. ex rel. Rigsby v. State Farm Fire & Cas. Co., No. 1:06CV433-HSO-RHW, 2014 WL 691500, at *6 (S.D. Miss. Feb. 21, 2014). But, the False Claims Act does not tell courts exactly what to consider when setting a civil FCA penalty. Therefore, courts consider many factors (they call this a “totality of the circumstances” test). Some of these factors include:

As we’ve discussed in elsewhere, government intervention is the most important factor in the success of a False Claims Act case. Part of this is because the vast resources of the government often convince defendants to settle. While settlements are a good thing for whistleblowers and the government, however, there is a possible downside.

Settlements require the agreement of both sides. When the Government settles a False Claims Act case they generally do not rely on the potential False Claims Act penalties to arrive at a settlement number. Instead, the settlements are usually based on a multiple of the agreed-upon damages.

The Excessive Fines Clause is part of the Eighth Amendment. It prohibits the government from imposing “excessive fines.” In 1998, the Supreme Court concluded that a civil penalty could violate the clause. United States v. Bajakajian, 524 U.S. 321 (1998). The Court concluded that civil fines violate the constitution when: (1) the forfeiture is “punitive”; and (2) a full forfeiture “would be grossly disproportional to the gravity of the offense.” Id. at 324, 334. For a complete discussion of the Bajakajian, see Suzanne E. Durrell, The Excessive Fines Clause of the Eighth Amendment and the Civil False Claims Act: To United States v. Bajakajian and Beyond, 27 Taxpayers Against Fraud Quarterly, 29 (July 2002).

Since Bajakajian, some courts have held that False Claims Act Penalties could potentially violate the Excessive Fines Clause. But no case has actually rejected penalties on this basis.

Courts look to several, non-exhaustive factors to determine whether a penalty was excessive such as:

(i) whether the defendant is in the class of persons at whom the statute was principally directed;

(ii) how the imposed penalties compare to other penalties authorized by the legislature; and

(iii) the harm caused by the defendant.

Courts have rejected defendants attempts to equate the harm in a False Claims Act case to actual damages. Thus, the Eleventh Circuit said in Yates v. Pinellas Hematology & Oncology,

Fraud harms the United States in ways untethered to the value of any ultimate payment. For instance, we have explained that when the United States is defrauded, the government has been damaged to the extent that such corruption causes a diminution of the public’s confidence in the government.

Courts also consider the deterrent effect of a monetary award. Courts often find that “[s]ubstantial penalties . . . serve as a powerful mechanism to dissuade” repeated violations of the FCA. Yates v. Pinellas Hematology & Oncology.

As we’ve explained above, a single fraudulent scheme can involve thousands of False Claims Act penalties. In addition, each penalty can be tens of thousands of dollars. Thus, it should come as no surprise that False Claims Act penalties add up considerably.

For instance, in United States ex rel. Bunk v. Gosselin World Wide Moving, N.V, government contractors submitted 9,136 invoices under contracts they obtained through bid-rigging. Although, the Government chose not to prove any damages at all and instead established 9,136 False Claims Act penalties. Therefore, even at the minimum penalty amount, the defendant faced over $50 million in FCA penalties. Subsequently, the government agreed to accept $24 million in settlement.

Health care fraud can also generate huge numbers of False Claims Act penalties. For example, in United States ex rel. Drakeford v. Tuomey, 792 F.3d 364, 386 (4th Cir. 2015), a hospital compensated its physicians in a way that violated the Stark Law against physician self-referrals. In other words, the hospital bribed the physicians to practice there. A jury found that the hospital violated the Stark Law and therefore the False Claims Act. It further found that Tuomey had submitted 21,730 false claims to Medicare with a total value of $39,313,065. The district court assessed 21,730 civil False Claims Act penalties. Ultimately, the hospital was on the hook for $119,515,000 in FCA penalties.

In United States ex rel. Kipp Fesenmaier v. The Cameron-Ehlen Group, Inc. dba Precision Lens, No. 13-cv-3003 (D. Minn., May 12, 2023), the jury found that Precision paid improper remuneration in the form of lavish trips and entertainment to ophthalmic surgeons. In return, the surgeons used Precision’s products in cataract surgeries reimbursed by Medicare. Thereafter, the jury concluded that Precision’s conduct had led to $43 million in false billings and the submission of 64,575 false claims. The court entered Judgment in the amount of $489.5 million, including statutory penalties of more than $358 million.

In United States ex rel Lutz v. BlueWave, No. 14-cv-00230 (D.S.C. May 23, 2018), a jury convicted defendants of violating the Anti-Kickback Statute to procure laboratory tests. Subsequently, the jury found that the defendants had presented over 38,000 claims, damaging the government by approximately $17 million. The court noted that the government could have sought 38,887 False Claims Act penalties for a total of between $213,878,500 and $427,757,000, but requested FCA penalties of $5000 and for only 11,500 of the claims. But, the court only imposed statutory penalties of over $63 million as part of a $114 million total award.

In United States ex rel. Yates v. Pinellas Hematology & Oncology, P.A., No. 8:16-cv-799-T-02TGW (M.D. Fla. Oct. 30, 2019), a jury found that the defendants relabeled lab results from an uncertified lab as originating elsewhere. The jury then determined that the defendants had made 214 false claims with economic damage of $755.54. Thus, the court imposed judgment of “$755.54 times three; plus 214 times $5,500.00” for a total award of $1,179,226.62. The Yates decision was later affirmed by the Eleventh Circuit.

When a mortgage company violated underwriting guidelines and therefore fraudulently obtained FHA insurance for its mortgages, it was liable for over 1000 FCA penalties. United States v. Americus Mortg. Corp., No. 4:12-CV-2676 (S.D. Tex. Sep. 14, 2017) Defendants falsely represented to HUD that FHA-insured loans had been underwritten with due diligence and were eligible for FHA insurance. As a result, the court found 1,295 False Claims Act penalties, totaling $12,950,000 as part of a $268,757,929 total award.

There are keys to know to understand False Claims Act penalties. Firstly, a False Claims Act penalty is required for every violation, this may be for each false claim, false statement, or other depending on the misconduct. Secondly, the potential False Claims Act penalty range range adjusts periodically to account for inflation. Thus, False Claims Act penalties are currently $13,946 to $27,894 per violation. Thirdly, a jury determines the number of statutory FCA penalties and a judge sets the precise FCA penalty per violation. Moreover, the judge can consider many factors including, seriousness of the misconduct, acceptance of responsibility, and how isolated the actions were. The large numbers of False Claims Act penalties possible in a single scheme, together with tens of thousands of dollars per violation, result in some False Claims Act penalties awards in the tens or hundreds of millions of dollars.