False Claims Act Violations and Prohibitions Explained

April 28, 2020

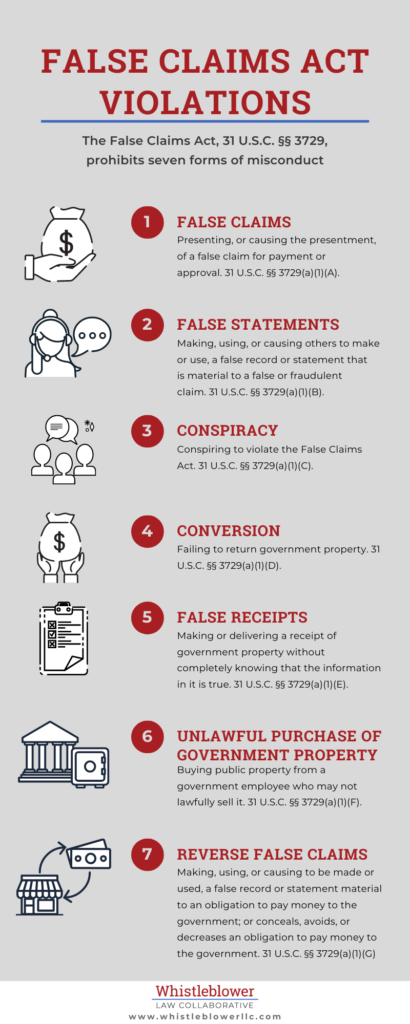

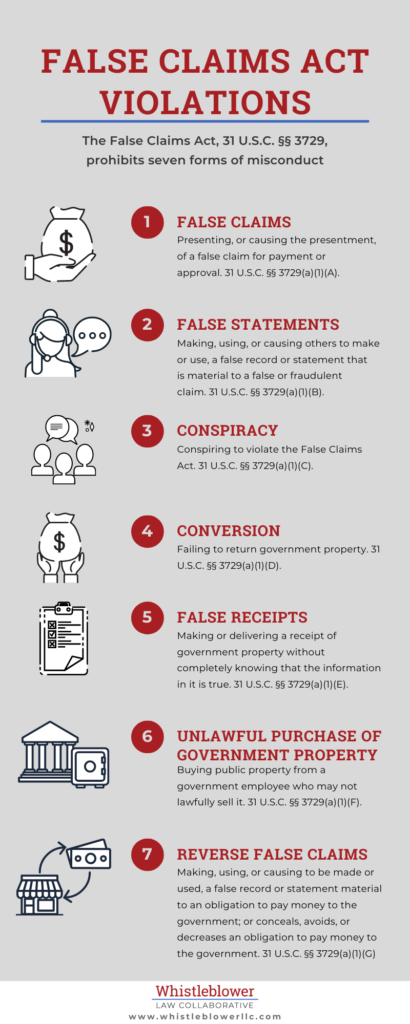

The False Claims Act is intended to reach all fraudulent attempts to cause the Government to pay out sums of money or to deliver property or services. United States v. Neifert-White Co., 390 U.S. 228, 232 (1968). The Current version of the False Claims Act lists seven violations which prohibit several different forms of misconduct, each of which is a violation of the False Claims Act.

The Current Version of the False Claims Act Prohibits Seven Types of Action

The current version of the False Claims Act identifies seven violations, any of which is a violation of the False Claims Act:

- False Claims – Presenting, or causing the presentment, of a false claim for payment or approval. 31 U.S.C. §§ 3729(a)(1)(A).

- False Records or Statements – Making, using, or causing others to make or use, a false record or statement that is material to a false or fraudulent claim. 31 U.S.C. §§ 3729(a)(1)(B).

- Conspiracy – Conspiring to violate the False Claims Act. 31 U.S.C. §§ 3729(a)(1)(C).

- Conversion – Failing to return government property. 31 U.S.C. §§ 3729(a)(1)(D).

- False Receipts – Making or delivering a receipt of government property without completely knowing that the information in it is true. 31 U.S.C. §§ 3729(a)(1)(E).

- Unlawful purchase of Government Property – Buying public property from a government employee who may not lawfully sell it. 31 U.S.C. §§ 3729(a)(1)(F).

- Reverse False Claims – Making, using, or causing to be made or used, a false record or statement material to an obligation to pay money to the government; or conceals, avoids, or decreases an obligation to pay money to the government. 31 U.S.C. §§ 3729(a)(1)(G).

Congress Explained That Many Different Fraudulent Actions Violate the False Claims Act

In 1986, as part of major revisions of the False Claims Act. The Senate issued a report explaining how the law worked and how it was supposed to work. Congress explained that False claims under the statute take many forms the most common being a claim for goods or services not provided, or provided in violation of contract terms, specification, statute, or regulation. S. Rep. No. 99-345, at 9-10, reprinted in 1986 U.S.C.C.A.N. at 5274.

The report also offers several examples of actions that congress believed would violate the False Claims Act.

- In Health Care – A false claim for reimbursement under the Medicare, Medicaid or similar program.

- A false application for a loan from a Government agency.

- A false claim in connection with a sale financed by Government Agencies such as the Agency for International Development or Export-Import Bank.

- Any claims made by individuals ineligible to participate in a program.

- Cashing a Government check, which was wrongfully or mistakenly obtained.

- A fraudulent attempt to pay the Government less than is owed in connection with any goods, services, concession, or other benefits provided by the Government is also a false claim under the act.

S. Rep. No. 99-345, at 9-10, reprinted in 1986 U.S.C.C.A.N. at 5274. Further, these claims may be false even though the services are provided as claimed. This can happen when someone is is ineligible to participate in the program, or obtains loans based on false statements. Id.