May 11, 2022

In May, the Government updated the Civil False Claims Act penalties to account for inflation. Now, for violations assessed after May 9, 2022, civil False Claims Act penalties will range from $12,537 to $25,076. Certain cases covered by the Railroad Retirement Board (RRB) and the Commerce Department had already been updated in January. This new adjustment comes only six months after the last adjustment of the civil False Claims Act penalties in December 2021.

False Claims Act penalties are mandatory for each separate violation of the law. Moreover, the law requires that the penalty amounts increase for inflation each year. As a result of these two factors, total penalty assessments can range from the millions to the tens of millions of dollars.

Whistleblowers and even other lawyers mistakenly think that the False Claims Act limits the civil penalty amount to $10,000 per violation. As a result, they often ignore the possibility of penalties when valuing a case. But this is a mistake.

Penalties are a possibility in every False Claims Act case. Understanding these nuances is key to properly assessing the impact that penalties may play on a case. If you are interested in learning more about False Claims Act penalties, we have a complete guide for you.

The False Claims Act, 31 U.S.C. §§ 3729, provides that anyone who violates the law “is liable to the United States Government for a civil penalty of not less than $5,000 and not more than $10,000, . . . plus 3 times the amount of damages.” But how does that apply in practice?

The False Claims Act imposes a penalty for each violation of the statute. These penalties can add up considerably. For example, in some cases courts have awarded thousands or even tens of thousands of penalties. This can result in tens or even hundreds of millions of dollars in False Claims Act Penalties awards.

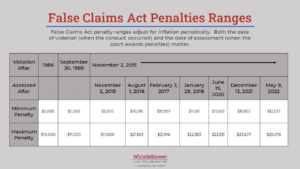

The 1986 law set penalties at $5000 to $10,000 per violation. Later federal law changed these amounts to account for inflation. In 1999 Congress increased the penalties to $5,500 to $11,000. In 2015, the inflation adjustment law was amended again and now federal agencies are responsible for updating the penalties annually. Now, both the date of violation and assessment matter for penalties. Since May 9, 2022, the penalties range between $12,537 to $25,076 for each claim.

DOJ last updated 2021 False Claims Act penalties in December. So this May 2022 penalties update comes only six months later. While that seems very fast, it is important to note that in 2019, DOJ didn’t update the penalties at all. So in some ways this simply signals that the government is returning to regular early-year updates.

Moreover, in January, two other agencies updated the FCA penalties applicable to cases involving their areas of expertise. Firstly, the Railroad Retirement Board increased the penalties to a range of $12,537 to $25,076. These would apply only to 2022 False Claims Act cases involving false claims submitted to that agency for retirement, disability or Medicare benefits. Likewise, the Department of Commerce updated the 2022 penalties for Reverse False Claims Act claims. The Department of Commerce has an interest in customs fraud which is frequently brought as a reverse false claims act case. 2022 False Claims Act penalties for those cases were likewise increased to a range of $12,537 to $25,076.

Now, the DOJ has updated the FCA penalties to match the penalties set by the RRB and Commerce Department in January. As such, the penalties for all three agencies now range from $12,537 to $25,076.

Civil penalties under the False Claims Act can amount to a huge portion of the recovery. When evaluating whether or not to bring a case, understanding False Claims Act penalties calculation is vital. Contact us for a free and confidential consultation.