The United States settled a False Claims Act case brought by two of our clients against Genexe, LLC d/b/a Genexe Health, its parent company Immerge, Inc., and two of the companies’ control persons and owners, Jason Green and Jason Gross. Under the terms of the Genexe settlement, Genexe, Immerge, Gross and Green will collectively pay $6 million plus interest to resolve the allegations of genetic testing fraud.

The fraudulent conduct was brought to light by multiple FCA qui tam cases filed by several whistleblowers, including two of our clients. The whistleblowers collectively will receive a relators’ share award of approximately $1.3 million from the settlement. Defendants are also paying the Relators’ reasonable attorneys’ fees and costs.

After investigating the claims raised in the relators’ FCA qui tam complaints, the United States alleged that during 2018 and 2019, Genexe, Immerge, Green, and Gross assisted with and caused to be submitted false claims to Medicare for CGx and PGx tests that were not medically necessary and that were procured through kickbacks. offered and paid to a network of independent contractors (IBOs), medical laboratories, medical providers, and telemedicine healthcare providers. Medicare does not cover clinical laboratory tests that are not medically necessary or that are tainted by kickbacks.

Genexe would obtain the genetic samples (usually from a cheek swab of saliva) for the CGx and PGx tests along with Medicare beneficiaries’ protected health care information and a physician order for the genetic test and send the Medicare beneficiary’s specimen and information to the laboratories for testing. Laboratories then billed Medicare for the fraudulent genetic testing and were regularly reimbursed at rates exceeding $6,000 per test. Once Medicare paid the medical laboratory, Genexe would receive a portion of the Medicare reimbursement funds from the laboratory; initially, Genexe was paid about $800 per swab, but later was paid amounts ranging from $1,000 to $2,000 depending on the type of genetic test.

This settlement is particularly notable because Jason Green and Jason Gross, two individual officers and owners of the companies, were held accountable by the United States and will collectively pay the settlement amount along with the companies. Green and Gross served, respectively, as the Chief Executive Officer and Chief Operating Officer of Genexe and Immerge, and they controlled and had ownership interests in the companies.

In the press release announcing the settlement, government officials emphasized the importance of identifying and ending genetic testing fraud scams.

Genetic testing fraud preys on the fears of patients, and it wastes taxpayer dollars by spending limited funds on medically unnecessary or nonexistent tests. This settlement shows we will work with our law enforcement partners to investigate fraud, waste, and abuse in federal healthcare programs and will use every tool available to recover improperly paid taxpayer funds.

United States Attorney David Metcalf

Medical professionals should only order testing which would benefit individual patient care, not for personal gain.

Maureen Dixon, Special Agent in Charge for the U.S. Department of Health and Human Services

Whistleblower Law Collaborative commends the outstanding efforts of their clients and the government prosecutors.

It was a privilege to represent two clients who were willing to come forward to alert the government to a national fraud scheme which preyed on elderly victims and cost taxpayers millions of dollars. The settlement announced today is a testament to the skill, resolve, and stamina of an outstanding team of government attorneys and investigators who put an end to that scheme and held those who profited accountable for their actions.

Bruce C. Judge, Partner, Whistleblower Law Collaborative

This is the third settlement of a genetic testing fraud FCA case brought by a client of WLC. We began sounding the alarm about genetic testing scams in 2018. Without the courage of whistleblowers, scams like this would go undetected.

MORSECORP, Inc. has agreed to pay $4.6 million, plus interest, to resolve allegations that it made false representations concerning compliance with required cybersecurity controls for safeguarding sensitive government information. This settlement is particularly notable because it represents the first major False Claims Act settlement with a defense contractor based on failures to implement required cybersecurity controls.

MORSECORP d/b/a MORSE (Mission Oriented Rapid Solution Engineering), which is based in Cambridge, Massachusetts, is a defense contractor in the U.S. National Security Ecosystem. MORSE performed multiple contracts for the Department of the Army and the Department of the Air Force, among other government customers.

The case was brought by our client in January 2023 based on his concerns that MORSECORP had not fully implemented cybersecurity controls required under NIST SP 800-171 for protecting sensitive government data and information. Our client was also concerned that MORSECORP did not have a consolidated system security plan and that MORSECORP was using third-party cloud-based services that did not meet the relevant Federal security requirements. In addition, our client was concerned that MORSECORP had posted improperly inflated SPRS assessment scores with the Defense Department for its internal cybersecurity practices and policies.

Our client brought the MORSECORP cybersecurity failures to the attention of the government by filing a cybersecurity qui tam complaint under the False Claims Act. Under the False Claims Act, a private citizen (known as a “relator”) who suspects or knows of fraud against the government can act as a whistleblower and file a sealed complaint on behalf of the government. If the case is successful, the relator is entitled to a share – between 15% and 30% – of the government’s recovery.

The government investigated the allegations brought to light by our client and, on March 17, 2025, filed a notice of its intention to intervene against MORSECORP for the purpose of settlement. The Department of Justice further described the case and the $4.6 million settlement on March 25, 2025.

Federal contractors must fulfill their obligations to protect sensitive government information from cyber threats, We will continue to hold contractors to their commitments to follow cybersecurity standards to ensure that federal agencies and taxpayers get what they paid for, and make sure that contractors who follow the rules are not at a competitive disadvantage.

— United States Attorney Leah B. Foley.

Protecting the integrity of Department of Defense (DoD) procurement activities is a top priority for the DoD Office of Inspector General’s Defense Criminal Investigative Service (DCIS). Failing to comply with DoD contract specifications and cybersecurity requirements puts DoD information and programs at risk. We will continue to work with our law enforcement partners and the Department of Justice to investigate allegations of false claims on DoD contracts.

— Special Agent in Charge Patrick J. Hegarty, DCIS Northeast Field Office

Our client expresses his admiration for, and appreciation of, the outstanding efforts of the Commercial Litigation Branch of the U.S. Department of Justice, the U.S Attorney’s Office for the District of Massachusetts, and the relevant investigating agencies for conducting a thorough and prompt investigation which led to the settlement announced yesterday.

In uniform and out, protecting the national security of the United States has been the focus of my professional career. Becoming a whistleblower was not an easy decision and one I only took when I felt I had no remaining option to protect sensitive government information. The Department of Justice should be commended for acting promptly to investigate and put an end to practices that placed sensitive government information and data at risk of loss or compromise.

–WLC Client

Whistleblower Law Collaborative commends the outstanding efforts of their client and the government prosecutors. Attorney Bruce C. Judge praised his client’s willingness to stand his ground on protecting sensitive government information. Mr. Judge also cited his client’s courage in coming forward without regard to the professional and personal risks that can attach to being a whistleblower. Mr. Judge continued,

[O]ur client drew on his extensive knowledge of the applicable cybersecurity requirements and was able to identify numerous cybersecurity gaps clearly and persuasively to government prosecutors and agents.

This settlement marks an important milestone in the government’s long-running efforts to bring about cybersecurity compliance in the Defense Industrial Base. After many years of issuing warnings and relying on self-certifications, the MORSECORP settlement sends a clear signal that government contractors who fail to implement required cybersecurity controls can expect to face significant financial penalties. It also signals that individuals who bring cybersecurity violations to the government’s attention can receive a share of the government’s ultimate recoveries.

In 2021, the Department of Justice launched its Civil Cyber-Fraud Initiative aimed at federal contractors who fail to comply with government cybersecurity requirements. In addition, the initiative targets contractors who fail to report breaches or other cybersecurity incidents.

We expect the Department of Justice, the Department of Defense, NASA, and other government agencies to continue to investigate and prosecute matters involving failure to implement required cybersecurity controls to safeguard sensitive government information and data.

This settlement among the United States, the States, and pharmaceutical companies Mallinckrodt plc and its subsidiary Mallinckrodt ARD LLC resolved allegations that Mallinckrodt violated the federal and state False Claims Acts by knowingly underpaying Medicaid rebates for its high-priced drug Acthar. The total settlement amount is $233,707,865 (plus interest). The United States will receive $123,642,146, and States will receive $110,065,718.

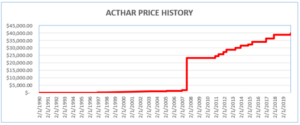

Mallinckrodt knowingly misreported Acthar’s base Average Manufacturer Price (“base AMP”) from January 2013 through June 2020. By doing so, it reduced the rebates it paid to the Medicaid Drug Rebate Program (MDRP) by approximately $650 million. Mallinckrodt had increased Acthar’s price from approximately $50 per vial in 2001 to almost $40,000 per vial.

Where a drug’s price is increased above the rate of inflation, manufacturers must pay an additional rebate. To avoid meeting its increased rebate obligations, Mallinckrodt began reporting Acthar’s base AMP as if it had been approved in 2010 (after the enormous price increases). Acthar, however, had been approved in 1952.

Our client, James Landolt, served as Mallinckrodt’s Director of Internal Controls, Gross to Net Accounting and Government Reporting from November 2015 until July 2017. In that position, he learned that Mallinckrodt had been misreporting the base AMP for Acthar and had underpaid the MDRP by hundreds of millions of dollars.

Mr. Landolt resigned from Mallinckrodt in 2017 and filed a qui tam action in 2018 alleging that Mallinckrodt’s knowing failure to pay correct rebates for Acthar violated federal and state False Claims Acts. In March 2020, the United States intervened in his lawsuit. In June 2020, twenty-eight states, the District of Columbia, and Puerto Rico also intervened.

While the False Claims Act was still under seal, Mallinckrodt sued the Center for Medicare and Medicaid Services (CMS) in federal court in the District of Columbia. Mallinckrodt sought a ruling that it was correctly reporting Acthar’s base AMP and did not have to comply with instructions from CMS to correct its reporting and pay what it owed. In March 2020, the District Court rejected Mallinckrodt’s argument. Two months later, it rejected Mallinckrodt’s motion for reconsideration and for a preliminary injunction.

In October 2020, Mallinckrodt filed for bankruptcy, which stayed the pending False Claims Act case. On March 2, 2022, the bankruptcy court confirmed Mallinckrodt’s plan of reorganization, which included this $234 million settlement.

As part of the settlement, Mallinckrodt entered into a five-year Corporate Integrity Agreement with HHS-OIG that requires, among other things, an independent review organization to annually review multiple aspects of the company’s practices relating to the Medicaid Drug Rebate Program. Mallinckrodt began reporting the correct base AMP for Acthar in June 2020 after losing its case in United States Court in D.C.

Mr. Landolt will receive a 20% share of amounts paid under the federal and state False Claims Acts. Whistleblowers like Mr. Landolt are critical in the fight against fraud. Under the False Claims Act, a private citizen-relator who suspects or knows of fraud against the government can file a sealed complaint on behalf of the government. In successful cases, the relator is entitled to a share of the government’s recovery.

Our firm is proud to be a member of the legal team representing the whistleblower in a recent municipal bond fraud settlement. The $70 million qui tam settlement was with eight of the nation’s largest banks. It is the largest reported settlement ever under the Illinois False Claims Act.

Our client, Edelweiss Fund LLC, alleged that various affiliates of eight large banks engaged in widespread fraud and collusion in the fees they charged and the interest rates they set for tax-exempt municipal bonds known as VRDOs. The defendant banks included: Bank of America, Barclays, Citigroup, JPMorgan Chase, Morgan Stanley, Fifth Third Bancorp, BMO, and William Blair.

Specifically, Edelweiss alleged that, while Illinois hired the defendant banks to market and price the bonds at the lowest possible interest rates, they instead engaged in a scheme to inflate the rates to collect millions in fees without providing the services for which they were retained. Edelweiss further alleged that the banks did this, among other reasons, to avoid having the bonds tendered back to them.

Edelweiss has brought similar lawsuits alleging the same municipal bond fraud scheme. Three additional cases — in California, New York, and New Jersey — are continuing.

Edelweiss’s principal is Johan Rosenberg. He has more than 30 years’ experience advising municipalities on VRDOs and other types of municipal bonds.

I am gratified by the settlement and hopeful we will obtain similar results for the other states. My goal continues to be securing for my clients and other state and local governments the lowest-cost municipal bond financing possible to maximize the overall benefit the public receives from the critical government projects these VRDOs fund.

–Johan Rosenberg

Under the Illinois False Claims Act and numerous other states, whistleblowers can bring lawsuits on behalf of the government against those committing fraud against the government. In return, successful whistleblowers can receive up to 30% of what the government recovers from the lawsuit.

For its successful settlement in Illinois, Edelweiss received the maximum reward of 30% of the government’s $48 million portion of the settlement. The remaining $22 million went towards Edelweiss’ legal fees and expenses in bringing the suit.

Edelweiss is represented in these matters by a large team of lawyers across the country. In addition to Whistleblower Law Collaborative LLC, the firms include Constantine Cannon, Schneider Wallace Cottrell Konecky LLP, McKool Smith, Behn & Wyetzner, DiCello Levitt LLP, Steyer Lowenthal Boodrookas Alvarez & Smith LLP, Stone & Magnanini LLP, and Howard Law. Erica Blachman Hitchings and David Lieberman are the WLC attorneys working on the Edelweiss matters.

The Securities and Exchange Commission (SEC) awarded more than $17 million to a whistleblower represented by Whistleblower Law Collaborative’s Suzanne Durrell and Bob Thomas. The whistleblower client submitted a tip under the SEC Whistleblower Program. The tip and subsequent information and assistance led to monetary sanctions in an SEC enforcement action and a related action. The SEC awarded our client 30% of the monetary sanctions collected, the highest percentage award allowed under the SEC Whistleblower Program.

[This] award underscores the SEC’s commitment to rewarding meritorious whistleblowers who provide valuable information and exemplary cooperation that advance the agency’s enforcement efforts,

–Creola Kelly, Chief of the SEC’s Office of the Whistleblower in announcing the award.

Attorneys Bob Thomas and Suzanne Durrell emphasized: “We and our client are very gratified that the SEC recognized and rewarded the extraordinary contributions of our client. We applaud the SEC for its impressive skill and dedication in prosecuting this matter, and for its highly successful track record in working with whistleblowers and their attorneys.”

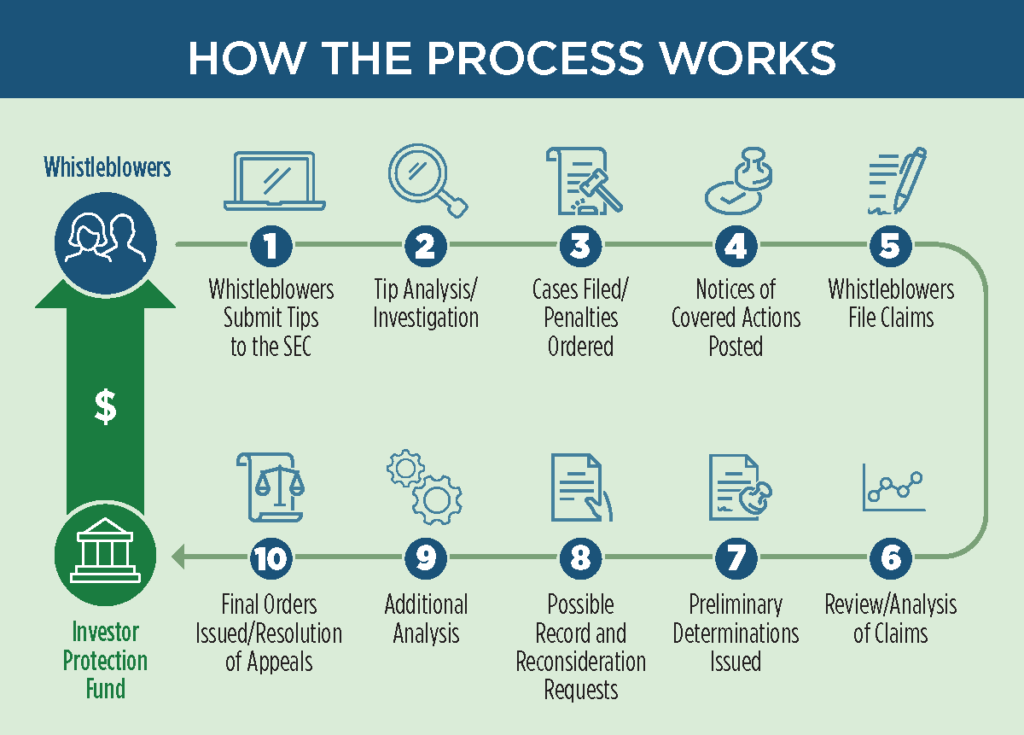

The SEC program operates somewhat differently than the False Claims Act and other qui tam statutes. SEC provides a very helpful graphic on the process:

In general, a whistleblower files a “Tip, Complaint, or Referral” form (TCR) with the SEC office of the whistleblower. The SEC then investigates and at its choice may pursue claims based on the tip. SEC periodically posts “notices of covered action.” These notices detail any results potentially subject to whistleblower rewards. Then, whistleblowers must file to claim their share of the recovery. Notably, the program does not give the whistleblower the right to pursue their own claims if the SEC does not.

The SEC may award between 10-30% of the monetary recoveries to an eligible whistleblower. It uses several factors in deciding how much to award. Here, the SEC noted that the highest possible award was appropriate because:

The SEC Whistleblower Program has been very successful. Since the program began, enforcement matters brought using information from meritorious whistleblowers have resulted in orders for nearly $5 billion in total monetary sanctions. This money is returned to the Investor Protection Fund for the benefit of taxpayers, defrauded investors, and others harmed by marketplace misconduct.

Since 2012, the SEC has awarded approximately $1.3 billion to over 275 individual whistleblowers. Importantly, the SEC provides all awards from the Investor Protection Fund. As a result, no money is taken or withheld from harmed investors to pay whistleblower awards.

Whistleblowers may be eligible for an award when they voluntarily provide the SEC with original, timely, and credible information that leads to a successful enforcement action. Whistleblower awards can range from 10 percent to 30 percent of the money collected when the monetary sanctions exceed $1 million.

Further, as in this matter, the SEC protects the confidentiality of whistleblowers and does not disclose any information that could reveal a whistleblower’s identity.

The Whistleblower Law Collaborative has secured awards for clients in several SEC whistleblower cases. It also represents whistleblowers in ongoing SEC investigations.

Whistleblower Law Collaborative LLC, based in Boston, devotes its practice entirely to representing clients nationwide in bringing actions under the federal and state whistleblower laws and programs, False Claims Acts and other whistleblower programs. We have extensive experience representing whistleblowers in False Claims Act and SEC matters.

If you are considering submitting a tip, complaint, or referral to the SEC or are aware of other types of fraud, contact us for a free, confidential consultation.

The United States has settled a federal False Claims Act qui tam case brought by a client of Whistleblower Law Collaborative LLC against Arthrex, Inc., a Florida-based medical device maker primarily to the orthopedic surgery industry. The settlement announced today by the Department of Justice and the United States Attorney for the District of Massachusetts involves allegations that Arthrex paid kickbacks to market two of its surgical products.

In announcing the settlement, Acting United States Attorney Nathaniel R. Mendell said:

Paying bribes to physicians to distort their medical decision-making corrupts the health care system. This settlement demonstrates our dedication to ensuring that taxpayers and patients get a health care system that is on the level. Kickbacks have no place anywhere in our health care system, and we will continue to identify and punish this illegal conduct.

Under the terms of the settlement, Arthrex has agreed to pay the United States $16 million plus interest to resolve allegations that it defrauded Medicare by paying illegal remuneration to Dr. Peter Millett, a Colorado based orthopedic surgeon, to induce him to purchase, order, or recommend the purchasing or ordering of Arthrex medical devices. Arthrex has also entered into a Corporate Integrity Agreement with the Department of Health and Human Services Office of Inspector General (HHS-OIG).

According to the settlement agreement with DOJ, the United States contends that in 2006, Arthrex had denied Dr. Millett’s request for royalties for his claimed contributions to the development of the SutureBridge and SpeedBridge kits—two Arthrex product lines that surgeons use in joint repair surgery. However, when Dr. Millett threatened to realign his loyalty to an Arthrex competitor in 2010, Arthrex not only acquiesced to Dr. Millett’s royalty request but also agreed to pay him royalties for past and future sales of SutureBridge and SpeedBridge kits at a higher percentage rate than was the company’s ordinary royalty practice. Pursuant to this agreement, Arthrex paid Dr. Millett millions of dollars.

The United States further contends that one purpose of Arthrex’s payments was to induce Dr. Millett to purchase, order, or recommend the purchasing or ordering of Arthrex medical devices, in violation of the federal Anti-Kickback Statute. Consequently, associated claims submitted to the Medicare program were false or fraudulent in violation of the False Claims Act.

Joseph R. Bonavolonta, Special Agent in Charge of the Federal Bureau of Investigation, Boston Division explained that

Arthrex may have believed it could increase profits by paying millions of dollars in kickbacks to a physician, under the guise of royalty payments, to increase the use of its products. But today’s $16 million settlement makes it clear that its unscrupulous scheme backfired. Anyone involved in, or entertaining, similar activity should know that health care fraud is a priority for the FBI, and we will pursue anyone trying to misuse this country’s vital health care system.

Acting Assistant Attorney General Brian M. Boynton for the Justice Department’s Civil Division emphasized:

The Department of Justice will continue to pursue medical device manufacturers that pay kickbacks to boost their profits. Such arrangements can improperly influence physicians’ decision-making and result in the misuse of critical federal health care program funds.

Arthrex also entered into a five-year Corporate Integrity Agreement (CIA) with HHS-OIG setting forth requirements for future compliance. HHS-OIG Special Agent Philip M. Coyne stressed that “Medical device manufacturers who engage in such kickback schemes undermine the integrity of federal health care programs.” He further noted that HHS-OIG will continue to work closely with its law enforcement partners “to protect patients and taxpayers by holding accountable companies that engage in unlawful activities.”

Our client brought Arthrex’s fraud to the attention of the government by filing a qui tam complaint under the False Claims Act. Under the False Claims Act, a private citizen (known as a “relator”) who suspects or knows of fraud against the government can act as a whistleblower and file a sealed complaint on behalf of the government. If the case is successful, the relator is entitled to a share – between 15% and 30% – of the government’s recovery.

I’m happy to have contributed to the Government’s awareness and investigation of this issue. Everyone involved in it did a great job, including the government attorneys and agents and my own attorneys. I’m glad that this came to a successful conclusion.

Whistleblower Law Collaborative LLC attorneys Bob Thomas, Suzanne Durrell, and David W.S. Lieberman commended the outstanding efforts of the government and applauded their client’s willingness to risk coming forward. Mr. Lieberman stressed the skillful work done by Assistant U.S. Attorneys David Derusha and Charlie Weinograd of the District of Massachusetts, and Department of Justice Trial Attorney Andrew J. Jaco. “The United States moved quickly and worked collaboratively with us to obtain this settlement.”

The Whistleblower Law Collaborative is also grateful for the assistance provided by their co-counsel, David Suny of McCormack Suny LLC in Boston, Massachusetts.