An oncology physician practice who did business with Cardinal Health paid the United States and the State of Michigan agreed to pay $1 million to resolve allegations that the practice accepted kickbacks from Cardinal in connection with the purchase of specialty pharmaceutical products from Cardinal. The physician practice was one of several such practices sued along with Cardinal Health. In January 2022, Cardinal Health agreed to pay the United States and the states $13.125 million plus interest to resolve allegations that it induced physician practices such as this one to purchase specialty pharmaceutical products from it by paying customers remuneration in advance of the practice making any drug purchases and not in connection with specific purchases. The practices in turn submitted claims for payment to Medicare and Medicaid programs that were tainted by these kickbacks. Litigation is ongoing as to several other named physician practice defendants.

Under the Anti-Kickback Statute, 42 U.S.C. § 1320a-7b(b), both sides of a kickback arrangement bear liability. It is important to hold both sides of the alleged kickback scheme (here, the payor/Cardinal and the payees/physician practices) accountable. Using the False Claims Act to do so protects the public fisc from paying claims tainted by kickbacks and protects patients. As the U.S. Attorney for the District of Massachusetts said at the time of the Cardinal settlement:

Kickback schemes, such as this one, have the potential to pervert clinical decision-making and are detrimental to our federal health care system and taxpayers.

Special Agent in Charge of the FBI Boston office added at the time: “Kickbacks cost health benefit programs millions of dollars in potentially fraudulent claims.”

Whistleblower Law Collaborative LLC is based in Boston. It devotes its nationwide practice to representing whistleblowers bringing actions under the federal and state False Claims Acts and other whistleblower programs. Under the False Claims Act, a private citizen who knows of fraud against the government can file a sealed complaint on behalf of the government. If the case is successful, the relator is entitled to a share of the government’s recovery. Among the firm’s many successes is the government’s $885 million settlement with AmerisourceBergen, another pharmaceutical drug wholesaler, for illegal repackaging of injectable drugs into pre-filled syringes.

In October, 2022, the United States settled a False Claims Act case brought one of our clients against DermaTran Health Solutions, LLC, a compounding pharmacy based in Rome, Georgia, its parent State Mutual Insurance Company, President Delos Yancey, and other defendants. Under the Agreement, Defendants agreed to pay over $6.87 million to resolve allegations that they violated the False Claims Act by waiving copays, charging the government higher prices than permitted, and trading federal healthcare business with other pharmacies.

As alleged in our Complaint,Yancey caused State Mutual Insurance subsidiaries to bankroll DermaTran Health Solutions, LLC, to sell “compounded” pain creams. Compounded drugs are drugs created by a pharmacy pursuant to a doctor’s order. These are often described as “custom” made formulations, but the vast majority of DermaTran’s compounds consisted of a very few formulations. Another State Mutual Insurance Company subsidiary named Pharmacy Insurance Administrators, LLC (“PIA”), was created to handle the billing for DermaTran.

Compound pain creams were very lucrative. Government-backed health insurance programs such as TRICARE (for the military) and the Federal Employees Health Benefits Program (for federal workers) would often reimburse thousands of dollars for these prescriptions. But the government programs imposed certain restrictions to limit spending. Most notably, these programs require that pharmacies charge them no more than the “usual and customary price”—or the price it would charge to cash-paying, uninsured patients.

In the interests of profit, the defendants ignored these restrictions. For example, they would represent to TRICARE that the hundreds or thousands of dollars they charged veterans was the “usual and customary” price for that drug. However, defendants regularly, and often the same day, sold the exact same prescription for as little as $30 when a patient’s insurance would not pay. Similarly, defendants utilized various schemes to avoid charging copays to patients to make them indifferent to the high prices they charged insurers. In some instances, DermaTran sales personnel offered and paid kickbacks to doctors to induce them to write prescriptions to the pharmacy.

Eventually, insurers began to terminate DermaTran from their networks. To keep the scheme alive, DermaTran, began transferring prescriptions to other pharmacies which kicked back part of the proceeds to DermaTran. Three other pharmacies, also named as defendants, participated in this prescriptions-trading scheme and settled claims: Legends Pharmacy (in Texas), Lake Side Pharmacy (in Alabama), and TriadRx (in Alabama).

Under the terms of the False Claims Act settlement, PIA contributed $6.5 million plus interest to the settlement. It also paid damages to our client for retaliating against her, which is illegal under the FCA.

DermaTran was sold to a third-party, the proceeds of that sale were also turned over to the government as part of the settlement. Legends Pharmacy will pay $59,293. TRIAD Rx, Inc. will pay $166,547. Lake Side Pharmacy is no longer in business, but former owners of Lake Side Pharmacy will pay $110,724.

The affected Government Agencies praised the settlement and thanked our client for coming forward:

Waiving copays and charging the government higher prices leads to overutilization and costs federal programs millions of dollars in unnecessary spending, Our office will continue to enforce the False Claims Act to recover government payments that result from such misconduct.

Northern District of Georgia U.S. Attorney Ryan Buchanan.

Health care fraud abuse like this case erodes the trust patients have in the health care system, the FBI will not stand by when there are allegations of companies operating corporate wide schemes to illegally line their pockets.

Keri Farley, Special Agent in Charge of FBI Atlanta.

Fraud through compounding pharmacies bilked billions out of TRICARE and undermined the integrity of our healthcare system designed to care for our service members and their families, I appreciate the partnership among involved law enforcement agencies and the U.S. Attorney’s Office to bring this matter to justice.

Cynthia Bruce, Special Agent in Charge of the Department of Defense, Office of Inspector General, Defense Criminal Investigative Service (DCIS).

The OPM OIG has no tolerance for businesses that knowingly take advantage of FEHBP, violating the rules to make a profit, I am extremely proud of the hard work of our investigators, analysts, and other law enforcement partners because overcharging the government is not a victimless crime – it contributes to higher premium prices and harms the financial integrity of the FEHBP.

Amy K. Parker, Special Agent in Charge, OPM OIG.

The U.S. Postal Service, Office of Inspector General, will continue to tirelessly investigate those who commit frauds against federal benefit programs and the U.S. Postal Service. This settlement is a clear message that the USPS OIG is dedicated to rooting out corruption and bringing to justice those responsible for these crimes, The USPS OIG would like to thank our law enforcement partners and the Department of Justice for their efforts in this investigation.

Special Agent in Charge Matthew Modafferi of the U.S. Postal Service, Office of Inspector General Northeast Area Field Office.

Health care providers that try to boost their profits by submitting fraudulent claims to Federal health care programs threaten the integrity of those programs and drive up prices for everyone, we work tirelessly alongside our law enforcement partners to protect the integrity of Federal health care programs and to ensure the appropriate use of taxpayer dollars.

Tamala E. Miles, Special Agent in Charge with the U.S. Department of Health and Human Services Office of Inspector General.

Our client was hired by State Mutual Insurance Company to provide accounting services for Dermatran. While there, she repeatedly expressed concerns about the practices she witnessed. However, after being repeatedly ignored by her employers she approached our firm to ask for assistance in providing government prosecutors with information about the alleged fraud. In 2017, we filed a complaint under the federal False Claims Act.

Under the False Claims Act, a private citizen (known as a “relator”) who suspects or knows of fraud against the government can act as a whistleblower and file a sealed complaint on behalf of the government. If the case is successful, the relator is entitled to a share – between 15% and 30% – of the government’s recovery.

In this case, our client will receive $1,434,775 or nearly 21% of the funds received by the government in addition to a payment from defendants as compensation for their retaliation against her.

The process of this suit was long, stressful and sometimes scary – but it was necessary. When you see people in business who take advantage of the system, without regard to the harm it causes to veterans, hard-working citizens, and taxpayers, you can’t stand by silently. I am grateful to my amazing legal team, for standing by my side throughout.

As this case illustrates, whistleblowers are a critical part of fraud enforcement. Last year, according to DOJqui tam cases resulted in over $1.6 billion in False Claims Act recoveries. The False Claims Act is one of the government’s most powerful tools to combat health care fraud.

Whistleblower Law Collaborative LLC attorney David W. S. Lieberman praised the outstanding work of Assistant U.S. Attorneys Anthony DeCinque, Neeli Ben-David, and Armen Adzhemyan. “This was an extremely complex fraud, but the attorneys in the Northern District of Georgia worked hand in glove with relator to understand the scheme and bring the case to a successful resolution.”

WLC attorneys Bruce Judge and Suzanne Durrell added their appreciation for WLC’s courageous client who sounded the alarm on this important issue. “Our client could easily have kept silent about the fraud she witnessed, but she did the right thing and came forward to tell the government about a serious fraudulent scheme that was draining millions from veterans and other vulnerable patients. We view this settlement as a clear vindication of her difficult choice to come forward.”

The Whistleblower Law Collaborative is also grateful for the assistance provided by our co-counsel, Julie Bracker and Jason Marcus of Bracker and Marcus and Joshua Russ and Allison Cook of Reese Marketos.

The Securities and Exchange Commission (SEC) awarded more than $17 million to a whistleblower represented by Whistleblower Law Collaborative’s Suzanne Durrell and Bob Thomas. The whistleblower client submitted a tip under the SEC Whistleblower Program. The tip and subsequent information and assistance led to monetary sanctions in an SEC enforcement action and a related action. The SEC awarded our client 30% of the monetary sanctions collected, the highest percentage award allowed under the SEC Whistleblower Program.

[This] award underscores the SEC’s commitment to rewarding meritorious whistleblowers who provide valuable information and exemplary cooperation that advance the agency’s enforcement efforts,

–Creola Kelly, Chief of the SEC’s Office of the Whistleblower in announcing the award.

Attorneys Bob Thomas and Suzanne Durrell emphasized: “We and our client are very gratified that the SEC recognized and rewarded the extraordinary contributions of our client. We applaud the SEC for its impressive skill and dedication in prosecuting this matter, and for its highly successful track record in working with whistleblowers and their attorneys.”

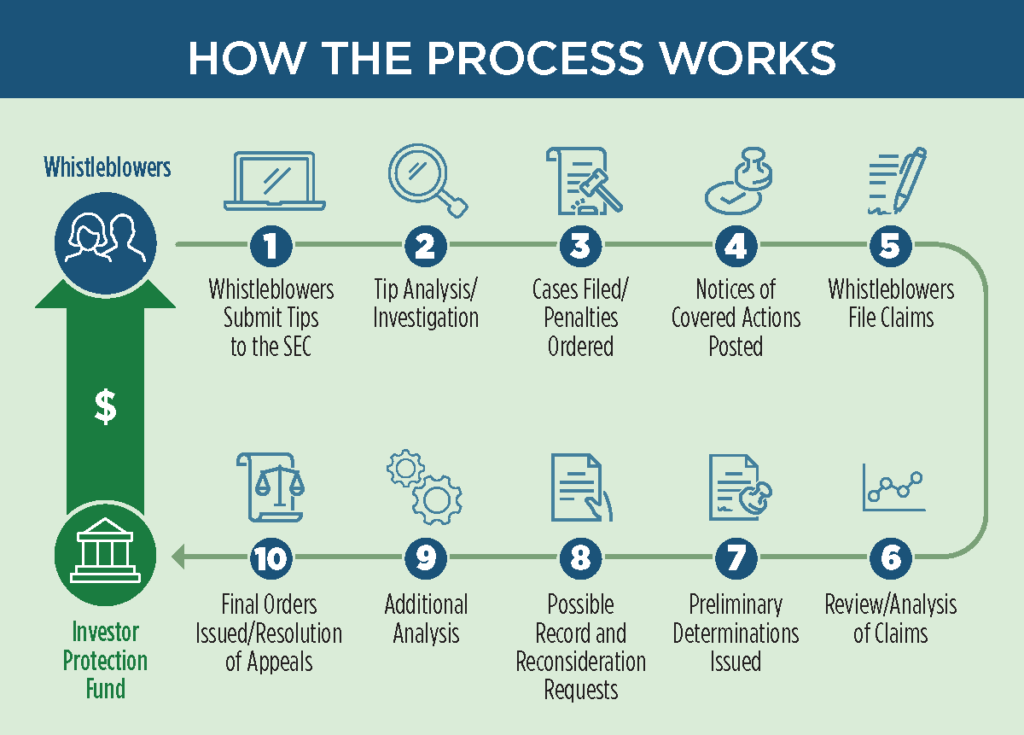

The SEC program operates somewhat differently than the False Claims Act and other qui tam statutes. SEC provides a very helpful graphic on the process:

In general, a whistleblower files a “Tip, Complaint, or Referral” form (TCR) with the SEC office of the whistleblower. The SEC then investigates and at its choice may pursue claims based on the tip. SEC periodically posts “notices of covered action.” These notices detail any results potentially subject to whistleblower rewards. Then, whistleblowers must file to claim their share of the recovery. Notably, the program does not give the whistleblower the right to pursue their own claims if the SEC does not.

The SEC may award between 10-30% of the monetary recoveries to an eligible whistleblower. It uses several factors in deciding how much to award. Here, the SEC noted that the highest possible award was appropriate because:

The SEC Whistleblower Program has been very successful. Since the program began, enforcement matters brought using information from meritorious whistleblowers have resulted in orders for nearly $5 billion in total monetary sanctions. This money is returned to the Investor Protection Fund for the benefit of taxpayers, defrauded investors, and others harmed by marketplace misconduct.

Since 2012, the SEC has awarded approximately $1.3 billion to over 275 individual whistleblowers. Importantly, the SEC provides all awards from the Investor Protection Fund. As a result, no money is taken or withheld from harmed investors to pay whistleblower awards.

Whistleblowers may be eligible for an award when they voluntarily provide the SEC with original, timely, and credible information that leads to a successful enforcement action. Whistleblower awards can range from 10 percent to 30 percent of the money collected when the monetary sanctions exceed $1 million.

Further, as in this matter, the SEC protects the confidentiality of whistleblowers and does not disclose any information that could reveal a whistleblower’s identity.

The Whistleblower Law Collaborative has secured awards for clients in several SEC whistleblower cases. It also represents whistleblowers in ongoing SEC investigations.

Whistleblower Law Collaborative LLC, based in Boston, devotes its practice entirely to representing clients nationwide in bringing actions under the federal and state whistleblower laws and programs, False Claims Acts and other whistleblower programs. We have extensive experience representing whistleblowers in False Claims Act and SEC matters.

If you are considering submitting a tip, complaint, or referral to the SEC or are aware of other types of fraud, contact us for a free, confidential consultation.