July 12, 2022

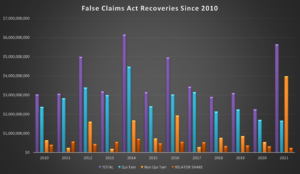

The Department of Justice released its annual statistical report on the 2021 False Claims Act recoveries and settlements. The report revealed DOJ’s 2021 False Claims Act recoveries in topped $5.6 billion. 2021 represented the program’s second largest total, and the largest since 2014. Remarkably, 2021 was the thirteenth consecutive year that total False Claims Act recoveries exceeded $2 billion. In fact, since 1986, False Claims Act recoveries have totaled over $70 billion.

Civil Division Acting Assistant Attorney General Boynton said:

[e]nsuring that citizens’ tax dollars are protected from fraud and abuse is among the department’s top priorities….The False Claims Act is one of the most important tools available to the department both to deter and to hold accountable those who seek to misuse public funds.

Whistleblowers continue to play an essential enforcement role. More than $1.6 billion of recoveries resulted from qui tam actions filed under the False Claims Act in 2021. But this is actually a much lower percentage than in recent years. For example, in 2019, about 70% of the recoveries resulted from qui tam actions. In 2018, whistleblowers accounted for 75%. 2017 saw a whopping 92% of whistleblower qui tam cases. We suspect the Purdue Pharma opioid settlement skewed the 2021 statistics.

In 2021, DOJ paid out $237 million in awards to the whistleblowers who exposed fraud by filing these actions. This was considerably lower than in recent years. For example, $265 million paid in 2019; $301 million paid in 2018; and, $392 million paid in 2017.

Whistleblowers filed 598 new qui tam suits in 2021, down from 675 filed in 2020. This appears to be the lowest number of new suits in several years.

Health care fraud continues to be the biggest area of recoveries. Of the more than $5.6 billion recovered in the top 2021 False Claims Act cases, $5 billion came from matters involving the health care industry. The recoveries came from all areas of the health care system. These include physicians, pharmaceutical companies, medical device manufacturers, Medicare Advantage Programs (Medicare Part C), and laboratories. Drug manufacturers: Indivior Inc. paid $209.3 million to resolve claims that it promoted the anti-addiction drug Suboxone for off-label uses. In addition, $4.5 million was recovered from the partial settlement of a whistleblower case brought by our client against opioid treatment center CleanSlate. Cleanslate ordered expensive lab tests regardless of medical necessity. It also violated the self-referral law by referring lab tests to a lab which it owned.

The False Claims Act is the government’s primary civil tool to combat fraud involving the government’s purchase of goods and services. Some examples include the payment of $50 million by Navistar Defense LLC to settle claims that it fraudulently induced the U.S. Marine Corps to pay inflated prices for a suspension system for armored vehicles. The government also recovered $11 million from AAR Corp. to resolve allegations that it knowingly failed to maintain helicopters in accordance with Department of Defense contract requirements. It also recovered monies related to several other government programs including education, mortgages, customs, and natural gas leases.

From the infamous Sackler family of Purdue Pharma fame, to individual physicians, and senior executive or owners of health care companies, DOJ continued its several year commitment to holding individuals accountable under the False Claims Act. The DOJ press release highlights several examples of settlements with such individuals.

Many people including DOJ officials expected serious fraud related to Covid-19. You can read about pandemic schemes on our blog. We also provide more details on the DOJ’s efforts in this area. So far the results are not evident, with DOJ’s FY2021 recoveries highlighting but a few cases with small recoveries. We suspect it is simply too early to see these whistleblower cases come to fruition. Most complex fraud cases take several years to investigate and resolve. Stay tuned. In addition, economic programs, such as PPP, have been the target of the most egregious fraud schemes. In those cases, the misconduct has been criminal, and the assets have disappeared making a civil recovery unlikely.

Interestingly, DOJ made a pitch for its Cybersecurity Initiative despite no recoveries in this area in FY2021. With some recoveries in this area already in FY2022, this is an up and coming area to watch. As with Covid related fraud, stay tuned.

While the DOJ statistics may ebb and flow from year to year, fraud is constant. So is the power of the FCA and the public private partnership between whistleblowers and the DOJ that Congress envisioned when it amended the FCA in 1986. Since then, over $70 billion has been recovered.

In representing whistleblowers, we see firsthand the courage of our clients and the importance of them stepping forward.

Industry insiders are uniquely positioned to expose fraud and false claims and often risk their careers to bring these schemes to light….Our efforts to protect taxpayer funds benefit from the courageous actions of these whistleblowers, and they are justly rewarded under the False Claims Act.

– Civil Division Acting Assistant Attorney General Boynton

We also see the professionalism and dedication of government attorneys, investigators, and others. We share their commitment to exposing fraud and recovering government funds on behalf of taxpayers. If you know of fraud involving a government agency, contact us for a free and confidential consultation.