The United States settled a False Claims Act case brought by two of our clients against Genexe, LLC d/b/a Genexe Health, its parent company Immerge, Inc., and two of the companies’ control persons and owners, Jason Green and Jason Gross. Under the terms of the Genexe settlement, Genexe, Immerge, Gross and Green will collectively pay $6 million plus interest to resolve the allegations of genetic testing fraud.

The fraudulent conduct was brought to light by multiple FCA qui tam cases filed by several whistleblowers, including two of our clients. The whistleblowers collectively will receive a relators’ share award of approximately $1.3 million from the settlement. Defendants are also paying the Relators’ reasonable attorneys’ fees and costs.

After investigating the claims raised in the relators’ FCA qui tam complaints, the United States alleged that during 2018 and 2019, Genexe, Immerge, Green, and Gross assisted with and caused to be submitted false claims to Medicare for CGx and PGx tests that were not medically necessary and that were procured through kickbacks. offered and paid to a network of independent contractors (IBOs), medical laboratories, medical providers, and telemedicine healthcare providers. Medicare does not cover clinical laboratory tests that are not medically necessary or that are tainted by kickbacks.

Genexe would obtain the genetic samples (usually from a cheek swab of saliva) for the CGx and PGx tests along with Medicare beneficiaries’ protected health care information and a physician order for the genetic test and send the Medicare beneficiary’s specimen and information to the laboratories for testing. Laboratories then billed Medicare for the fraudulent genetic testing and were regularly reimbursed at rates exceeding $6,000 per test. Once Medicare paid the medical laboratory, Genexe would receive a portion of the Medicare reimbursement funds from the laboratory; initially, Genexe was paid about $800 per swab, but later was paid amounts ranging from $1,000 to $2,000 depending on the type of genetic test.

This settlement is particularly notable because Jason Green and Jason Gross, two individual officers and owners of the companies, were held accountable by the United States and will collectively pay the settlement amount along with the companies. Green and Gross served, respectively, as the Chief Executive Officer and Chief Operating Officer of Genexe and Immerge, and they controlled and had ownership interests in the companies.

In the press release announcing the settlement, government officials emphasized the importance of identifying and ending genetic testing fraud scams.

Genetic testing fraud preys on the fears of patients, and it wastes taxpayer dollars by spending limited funds on medically unnecessary or nonexistent tests. This settlement shows we will work with our law enforcement partners to investigate fraud, waste, and abuse in federal healthcare programs and will use every tool available to recover improperly paid taxpayer funds.

United States Attorney David Metcalf

Medical professionals should only order testing which would benefit individual patient care, not for personal gain.

Maureen Dixon, Special Agent in Charge for the U.S. Department of Health and Human Services

Whistleblower Law Collaborative commends the outstanding efforts of their clients and the government prosecutors.

It was a privilege to represent two clients who were willing to come forward to alert the government to a national fraud scheme which preyed on elderly victims and cost taxpayers millions of dollars. The settlement announced today is a testament to the skill, resolve, and stamina of an outstanding team of government attorneys and investigators who put an end to that scheme and held those who profited accountable for their actions.

Bruce C. Judge, Partner, Whistleblower Law Collaborative

This is the third settlement of a genetic testing fraud FCA case brought by a client of WLC. We began sounding the alarm about genetic testing scams in 2018. Without the courage of whistleblowers, scams like this would go undetected.

In May 2023, the United States settled a False Claims Act case that our client brought against Massachusetts Eye and Ear Infirmary (“MEEI”) and other defendants in 2018. Our client alleged that some of the physicians working for Massachusetts Eye and Ear received kickbacks to induce referrals to MEEI for outpatient procedures in violation of the Stark Law, the Anti-Kickback Statute (“AKS”), and False Claims Act. The False Claims Act settlement requires Massachusetts Eye and Ear to pay $5.7 million, plus interest. A portion of MEEI’s payment will be paid to our client.

Massachusetts Eye and Ear made improper incentive payments to certain physicians. As a result, these financial relationships violated the Physician Self-Referral Law (commonly known as the Stark Law) and the Anti-Kickback Statute (“AKS”). Therefore, when the physicians referred their patients to MEEI for procedures and MEEI submitted claims to government health care programs such as Medicare, it violated the False Claims Act.

Under the terms of the False Claims Act settlement, MEEI will pay $5.7 million plus interest to the settlement.

Our client provided government prosecutors with information about the alleged fraud. In 2018, we filed a qui tam complaint under the federal False Claims Acts. Under the False Claims Act, a private citizen (known as a “relator”) who suspects or knows of fraud against the government can act as a whistleblower and file a sealed complaint on behalf of the government. For successful cases, the government pays a share – between 15% and 30% – to the relator. In this case, our client will receive 17 percent of the recovery.

Here, the United States contended that MEEI’s incentive payments created a financial relationship between MEEI and those physicians. Because of that financial relationship, referrals by those physicians to MEEI were improper and violated the Stark Law.

Stark Act violations drive up the overall costs of the health care system due to fraud and abuse. We will continue to vigorously investigate False Claims Act violations arising out of improper financial relationships between hospitals and physicians.

–Acting United States Attorney Joshua Levy.

We all rely on our health care providers to make treatment decisions based on clinical needs, not financial ones arising out of improper relationships between physicians and hospitals. Today’s settlement with Massachusetts Eye and Ear demonstrates the FBI’s ongoing commitment to ensure that publicly funded health care programs to which we all contribute and on which we all depend are not abused.

— Joseph R. Bonavolonta, Special Agent in Charge of the Federal Bureau of Investigation, Boston Division.

In announcing the settlement, Phillip M. Coyne, Special Agent in Charge of the Department of Health and Human Services, Office of Inspector General (HHS-OIG) said:

This settlement is a warning to other health care entities that seek to boost their profits by entering into improper financial arrangements with referring physicians. Working with our law enforcement partners, we will continue to investigate such deals to prevent financial arrangements that could undermine impartial medical judgement, drive up health care costs, and corrode the public’s trust in the health care system.

As this case illustrates, whistleblowers are a critical part of fraud enforcement. Last year, according to DOJ, qui tam cases resulted in over $2.2 billion in False Claims Act recoveries.

Whistleblower Law Collaborative LLC, based in Boston, devotes its practice entirely to representing clients nationwide in bringing actions under the federal and state False Claims Acts and other whistleblower programs. Among the firm’s many successes is a $234 million settlement with Mallinckrodt under federal and state False Claims Acts for Medicaid rebate fraud.

In July 2022, the United States, Massachusetts, and Connecticut settled a False Claims Act case that our client brought against BioReference Health, LLC. BioReference is one of the largest clinical laboratories in the United States. The case alleged that BioReference paid kickbacks to physicians to induce referrals for its laboratory tests.

In announcing the settlement, United States Attorney Rachael S. Rollins said:

Medical decisions by doctors should be based on what is best for each patient, not a doctor’s personal financial interest. When companies violate the federal health care laws that are meant to protect patients, health care costs for hard working people increase. We will continue to find fraud and use the False Claims Act to make companies that break the law pay back the taxpayers they defrauded as well as pay a financial price for their misconduct.

Under the terms of the False Claims Act settlement, the defendants will pay $10 million, plus interest. BioReference also has entered into a Corporate Integrity Agreement with the HHS Office of Inspector General (HHS-OIG).

The government alleged that BioReference induced physician practices to send their laboratory business to BioReference by paying them above-market rent. The payments were for BioReference to lease space for its Patient Service Centers (“PSCs”). PSCs are locations where BioReference collects patients’ blood samples for testing. These excessive lease payments violated the Physician Self-Referral Law (commonly known as the Stark Law) and the Anti-Kickback Statute (“AKS”). As the United States Attorney’s Office explained in its press release, “Both the Stark Law and the Anti-Kickback Statute are intended to ensure that physicians’ medical judgments are not compromised by improper financial inducements.” Because of these improper payments, BioReference submitted or caused the submission of false claims for payment to federal healthcare programs.

Defendants admitted that, for several years, BioReference made lease payments to physicians and physician practices that exceeded fair market value. Defendants further admitted that, in deciding whether to open, maintain, or close PSCs, BioReference analyzed referrals from nearby healthcare providers. Significantly, BioReference considered referrals from many of the physician-lessors who received excessive rent payments. Finally, defendants conducted internal audits between 2017 and 2019 that identified excessive lease payments to some physician-lessors. However, they failed to report or return any overpayments to government health care programs.

Our client provided government prosecutors with information about the alleged fraud. In 2019, we filed a qui tam complaint under federal and state False Claims Acts. Under the False Claims Act, a private citizen (known as a “relator”) who suspects or knows of fraud against the government can act as a whistleblower and file a sealed complaint on behalf of the government. For successful cases, the government pays a share – between 15% and 30% – to the relator. In this case, our client will receive 17 percent of the recovery.

In DOJ’s press release, the Federal Bureau of Investigation thanked our client, stating:

Laboratories that scheme to enrich their businesses through health care fraud—such as by paying kickbacks—drive up health care costs for everyone. This settlement shows how seriously the FBI takes its responsibility to weed them out, and we’d also like to thank the whistleblower in this case for helping us ensure these entities are held accountable.

-Joseph R. Bonavolonta, Special Agent in Charge of the FBI Boston Division

As this case illustrates, whistleblowers are a critical part of fraud enforcement. Last year, according to DOJ, qui tam cases resulted in over $1.6 billion in False Claims Act recoveries. DOJ noted in announcing this settlement that the False Claims Act is one of government’s most powerful tools to combat healthcare fraud.

The Whistleblower Law Collaborative LLC, based in Boston, devotes its practice entirely to representing clients nationwide in bringing actions under the federal and state False Claims Acts and other whistleblower programs. Among the firm’s many successes is a $234 million settlement earlier this year with Mallinckrodt under federal and state False Claims Acts for Medicaid rebate fraud.

This settlement among the United States, the States, and pharmaceutical companies Mallinckrodt plc and its subsidiary Mallinckrodt ARD LLC resolved allegations that Mallinckrodt violated the federal and state False Claims Acts by knowingly underpaying Medicaid rebates for its high-priced drug Acthar. The total settlement amount is $233,707,865 (plus interest). The United States will receive $123,642,146, and States will receive $110,065,718.

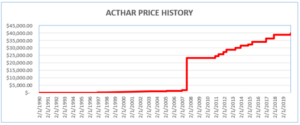

Mallinckrodt knowingly misreported Acthar’s base Average Manufacturer Price (“base AMP”) from January 2013 through June 2020. By doing so, it reduced the rebates it paid to the Medicaid Drug Rebate Program (MDRP) by approximately $650 million. Mallinckrodt had increased Acthar’s price from approximately $50 per vial in 2001 to almost $40,000 per vial.

Where a drug’s price is increased above the rate of inflation, manufacturers must pay an additional rebate. To avoid meeting its increased rebate obligations, Mallinckrodt began reporting Acthar’s base AMP as if it had been approved in 2010 (after the enormous price increases). Acthar, however, had been approved in 1952.

Our client, James Landolt, served as Mallinckrodt’s Director of Internal Controls, Gross to Net Accounting and Government Reporting from November 2015 until July 2017. In that position, he learned that Mallinckrodt had been misreporting the base AMP for Acthar and had underpaid the MDRP by hundreds of millions of dollars.

Mr. Landolt resigned from Mallinckrodt in 2017 and filed a qui tam action in 2018 alleging that Mallinckrodt’s knowing failure to pay correct rebates for Acthar violated federal and state False Claims Acts. In March 2020, the United States intervened in his lawsuit. In June 2020, twenty-eight states, the District of Columbia, and Puerto Rico also intervened.

While the False Claims Act was still under seal, Mallinckrodt sued the Center for Medicare and Medicaid Services (CMS) in federal court in the District of Columbia. Mallinckrodt sought a ruling that it was correctly reporting Acthar’s base AMP and did not have to comply with instructions from CMS to correct its reporting and pay what it owed. In March 2020, the District Court rejected Mallinckrodt’s argument. Two months later, it rejected Mallinckrodt’s motion for reconsideration and for a preliminary injunction.

In October 2020, Mallinckrodt filed for bankruptcy, which stayed the pending False Claims Act case. On March 2, 2022, the bankruptcy court confirmed Mallinckrodt’s plan of reorganization, which included this $234 million settlement.

As part of the settlement, Mallinckrodt entered into a five-year Corporate Integrity Agreement with HHS-OIG that requires, among other things, an independent review organization to annually review multiple aspects of the company’s practices relating to the Medicaid Drug Rebate Program. Mallinckrodt began reporting the correct base AMP for Acthar in June 2020 after losing its case in United States Court in D.C.

Mr. Landolt will receive a 20% share of amounts paid under the federal and state False Claims Acts. Whistleblowers like Mr. Landolt are critical in the fight against fraud. Under the False Claims Act, a private citizen-relator who suspects or knows of fraud against the government can file a sealed complaint on behalf of the government. In successful cases, the relator is entitled to a share of the government’s recovery.