July 1, 2020

In June, DOJ updated the 2020 False Claims Act penalties to a range of $11,665 to $23,331. False Claims Act penalties are mandatory for each separate violation of the law. A single fraudulent scheme can involve thousands of violations. So, total 2020 False Claims Act penalties assessments can run to the millions or tens of millions of dollars.

Whistleblowers and even other lawyers mistakenly think that the False Claims Act limits the penalty to $10,000. Often this leads them to ignore penalties when valuing a case.

Understanding these nuances is key to properly assessing the impact that penalties may play on a case. If you are interested in learning more about False Claims Act penalties, we have a full guide for you.

The False Claims Act, 31 U.S.C. §§ 3729, provides that anyone who violates the law “is liable to the United States Government for a civil penalty of not less than $5,000 and not more than $10,000, . . . plus 3 times the amount of damages.” But how does that apply in practice?

The FCA imposes a separate penalty for each violation of the statute. These penalties can add up considerably. In some cases, courts have awarded thousands or even tens of thousands of penalties. This can result in tens or even hundreds of millions of dollars in False Claims Act Penalties awards.

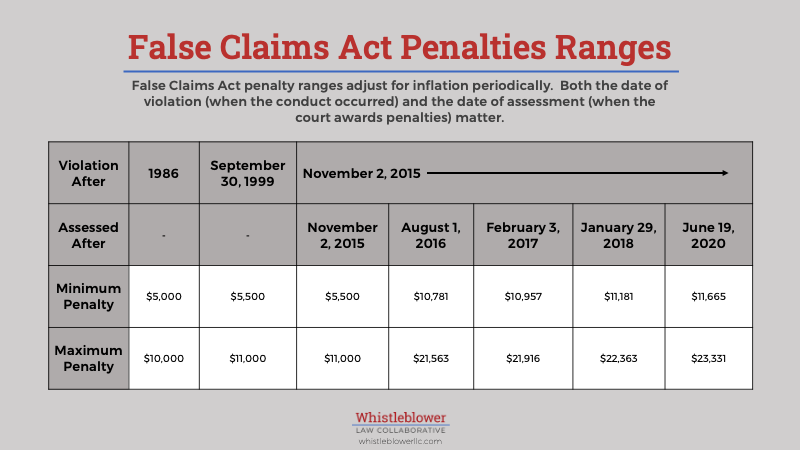

The 1986 law set penalties at $5000 to $10,000 per violation. Later federal law changed these amounts to account for inflation. Moreover, it made federal agencies responsible for updating the penalties annually.

As a result, both the date of violation and the date of assessment matter for penalties.

Violations Ocurring before November 2, 2015:

Violations after November 2, 2015 the date of assessment matters:

DOJ did not formally update the 2019 False Claims Act Penalties so those remained at the 2018 level of $11,181 to $22,363. However, on June 19, DOJ adjusted False Claims Act penalties for 2020. 85 Fed. Reg. 37004. This adjustment accounted for the missed 2019 inflation increase. Thus, it was a “double increase.” As a result, after June 20, 2020 False Claims Act Penalties, for conduct after November 2, 2015, will be from $11,665 to $23,331.

Penalties under the False Claims Act can amount to huge portions of a recovery. When evaluating whether or not to bring a case, understanding False Claims Act penalties calculation is vital. In June, 2020 DOJ updated the FCA penalties range to $11,665, to $23,331.